Financial stability is at risk due to the potential impacts of climate change. According to a World Bank recent report this reality could harm the banking sector, especially in countries like Morocco.

In a first of its kind report, the World Bank and Bank Al-Maghrib, the Moroccan central bank, partnered, with the help of the French Development Agency (AFD), to look into the impact of climate risks on the Moroccan banking sector.

The report finds that climate change could, indeed, hurt banks in Morocco. Experiencing droughts, floods and other climate risks could hurt both people and businesses, who could, in turn, default on loans, the report shows.

In more details, the research identifies two main climate risks for Moroccan banks : physical risks and transition risks.

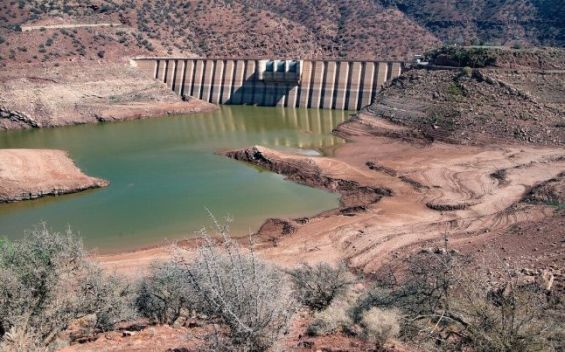

Drought and floods

Physical risks consist of problems caused by weather events like floods and droughts. These natural events mostly harm farmers who often borrow money from banks to finance their activities and who in the face of natural and unpredicted catastrophes could be unable to shoulder their financial obligations towards banks.

«Natural catastrophes could affect property, corporate assets, household wealth, and firm profits, which could in turn reduce borrowers’ ability to service their debt», explains the same report.

Crop producers and livestock farmers, for instance, could face significant economic losses from droughts, a natural hazard to which Morocco is particularly vulnerable, it explains. «This means that banks that are exposed to the agricultural sector could be directly affected by climate physical risks, while banks that are exposed to other sectors that are connected to the agricultural sector through the value chain (e.g., food processing and tourism) may also be adversely affected», it showed.

Natural events like floods could also affect the banking sector by reducing the value of assets and properties and disrupting infrastructure.

Climate transition risks

As for transition risks, the report explains that these are problems caused by the shift to a cleaner economy and how harmful that could be to the banking sector in Morocco.

As countries try to reduce pollution, some businesses may struggle, hurting banks that lend to them. The report found that «overall credit exposure to industries defined as highly or moderately transition-sensitive accounts for 24.3 percent of total loans and 43.6 percent of loans to nonfinancial corporates (NFC)».

Exposures are highest to the manufacturing sector (9 % of total loans), electricity (5 % of total loans), and agriculture (4 % of total loans), the report added.

«The analysis suggests that exposure to transition risks is concentrated in small and medium-sized banks that have specialized credit portfolios».

To overcome these risks, the report provides a set of recommendations to the banking sector. The recommendations consist of understanding climate-related financial risks, developing a plan to further integrate climate risk analysis into the central bank’s macro- and microprudential monitoring and assessment framework and collaborating with relevant ministries and authorities to provide forward-looking climate guidance, among others.

chargement...

chargement...