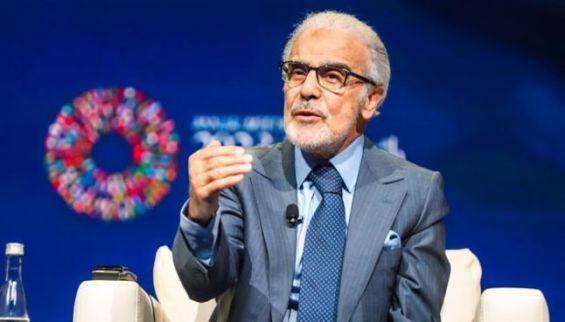

Morocco is planning to loosen its exchange rate regime in 2026, gradually resuming the plan interrupted by the pandemic, Bloomberg News reported, quoting Bank Al-Maghrib Governor Abdellatif Jouahri.

While attending the annual meetings of the International Monetary Fund and the World Bank in Washington DC, Jouahri stated that «the move would involve gradually shifting the dirham from its current peg, which is based on a basket of euros and US dollars».

«The central bank is technically prepared», he added, explaining that a transition plan is underway to ensure that «the banks are ready».

«Future steps will lead to a currency determined by the market», he noted. «More time and stewardship are needed for market participants, especially small businesses that account for the majority of the country’s output», he explained.

The governor also mentioned that «authorities are considering issuing at least $1 billion in Eurobonds by early 2025». However, he said Morocco will have to wait and observe «global uncertainties surrounding the U.S. presidential election and the potential implications of the next administration’s Middle East policies».

Morocco first announced plans for a more flexible currency exchange regime in 2018, but the process was interrupted by the impact of the COVID-19 pandemic on tourism.

chargement...

chargement...